As the global contest for economic and strategic advantage intensifies, emerging markets – especially in Asia – have become central to the race for resources. Professor Dr Jacky Tang, Deutsche Bank’s CIO for Emerging Markets, explores how this fierce competition for critical commodities, shifting supply chains and evolving policy landscapes are shaping risks and opportunities for investors in 2026 and beyond.

In an ever-changing landscape, the quest for commodities is a constant – especially when it comes to rare earths. These materials are fundamental to industry and national defence, and many emerging market countries hold an advantage in the space.

While iron, copper, silicon, and crude oil have long been the backbone of economic progress, rare earth elements have fast become a foundation for the next wave of innovation. These 17 metals are indispensable for the manufacturing of advanced semiconductors, high-performance magnets, batteries, and specialised alloys. As we enter a new era of technological transformation, their significance is now more obvious than ever.

“Commodities are at the heart of today’s global contest for economic and strategic advantage,” says Professor Dr Jacky Tang, Deutsche Bank Private Bank’s CIO for Emerging Markets. “The battle is fiercest around rare earths and critical minerals – essential for everything from AI servers and electric vehicles (EVs) to wind turbines and defence systems.”

The numbers are striking: an EV motor relies on hundreds of grams of neodymium, dysprosium, and praseodymium, while a single F-35 fighter jet can be made up of over 400 kilograms of rare earths. This dependency underscores the economic value of these materials as well as their growing role in shaping national security and technological leadership.

In the context of intensifying geopolitical competition, ensuring reliable access to rare earths is now a central concern for policymakers and investors alike.

“Emerging markets – especially in Asia – are both battlegrounds and beneficiaries,” notes Tang. “They control much of the world’s mining and processing capacity and are now attracting investment as companies and countries seek to diversify away from single-source dependencies.”

Resources in demand, and China dominates

While rare earths are not actually rare in terms of their geological abundance, extracting and processing them is both expensive and environmentally damaging as they are difficult to isolate and purify. Producing just one tonne of rare earths not only releases particulates and waste gases but also generates around 75 cubic metres of toxic wastewater, and a tonne of radioactive byproducts.

The environmental toll has been so severe that, around the turn of the millennium, many rare earth mines worldwide were closed down. China, however, dramatically expanded its capacity, establishing its dominance in the global rare earths market.

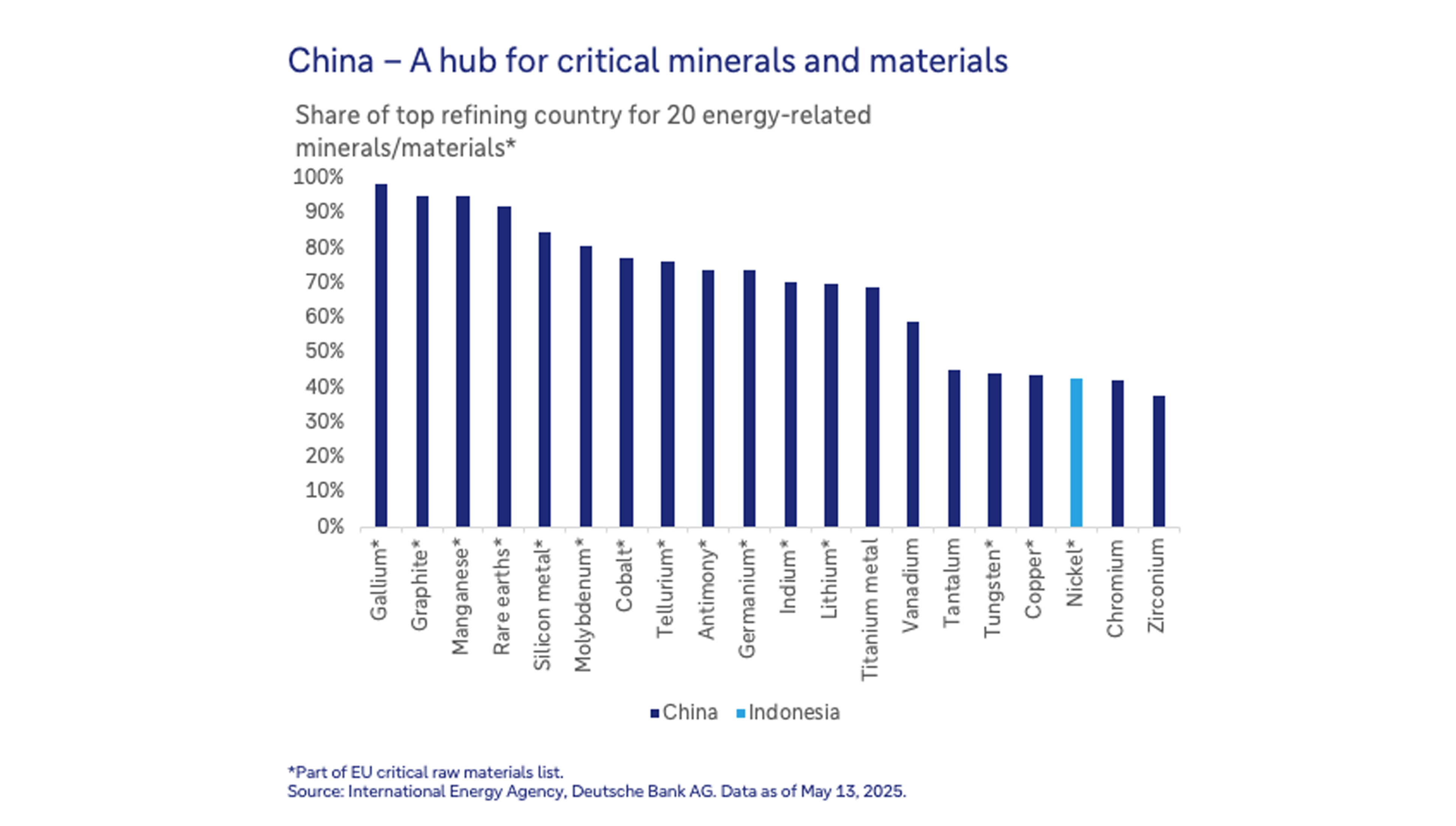

As former Chinese leader Deng Xiaoping famously remarked: “The Middle East has oil, we have rare earths.” Today, this statement resonates more than ever. China now refines 92% of the world’s industrial-grade rare earths[1]. The Asian powerhouse effectively holds a quasi-monopoly, securing its position at the heart of global supply chains.

Between 2000 and 2021, China invested nearly 57 billion US dollars to support copper, cobalt, nickel, lithium and rare earth projects across almost 20 emerging market countries[2]. The Asian superpower remains both the leading supplier of all key refined critical minerals by geography and ownership, as well as the largest source of demand, according to the International Energy Agency.

China’s grip on the rare earths market was thrown into sharp relief in autumn 2025. As trade tensions with the US escalated, Beijing tightened export controls on these critical materials, sending ripples through global supply chains. It wasn’t until a late-October agreement that some of the pressure eased, but the episode underscored just how pivotal rare earths have become to modern industry, and the global economy.

“For investors, the race for resources is intensifying, and we expect continued efforts to find substitutes for rare earths, but these are hard to replace in the short term,” says Tang.

“The bottom line is commodities are no longer just cyclical, they’re strategic,” he outlines. “The contest for control, for rare earths particularly, will shape global supply chains, drive policy, and create both risks and opportunities for portfolios in 2026 and beyond.”

Asia – a global growth centre

Asia is set to remain the growth engine of the global economy going forward. China remains the most significant player, accounting for around 33% of the MSCI Emerging Markets Asia Index. The government’s new five-year plan focuses on innovation, technological independence, and green technologies, but higher social spending, weakening international demand, and policy uncertainties could act as headwinds.

“We think Chinese fiscal policies in 2026 could focus on two areas,” says Tang. “Firstly, more consumption support is likely, including subsidising current household spending items, creating new consumption opportunities – especially in services – and promoting the application of new technology in consumption.”

He adds: “Secondly, infrastructure investment could accelerate with the announcement of some major projects, which could be the most effective way of offsetting some aspects of property market weakness.”

Sectors such as technology, renewable energy, and electromobility are likely to derive the most benefit from Beijing’s economic strategy, in our view.

Elsewhere, Taiwan and South Korea, with their world-leading chip manufacturing, also stand out as investment targets. Nevertheless, tensions between China and Taiwan continue to create uncertainty, particularly surrounding the semiconductor industry. Due to Taiwan’s pivotal role in the production of semiconductors – comprised of crucial rare earth elements and fundamental to the AI ecosystem – this dispute could have far-reaching economic consequences.

India’s equity market, meanwhile, may face short-term headwinds due to high valuations and trade concerns, but supportive reforms and potential double-digit profit growth in 2026 could make Indian equities an attractive option for diversification.

The Middle East's growing importance

Beyond Asia, the Middle East’s significance on the world stage continues to gain traction. Looking beyond the overall dominance of the oil trade, the economy in this growth region is making rapid progress with its transformation. One example is Saudi Arabia’s “Vision 2030”, with its planned investments in healthcare, renewable energy, and data centres.

The UAE also offers broad diversification having rapidly evolved into a nexus for communications and technology, drawing capital and talent from every corner of the world. Its role as a magnet for wealth and assets underscores the country’s transformation into a hub for innovation and connectivity.

Israel, meanwhile, continues to carve out leadership positions in high-value sectors, most notably cyber security. The breadth of investment opportunities in Israel reflects its status as a global pioneer in many fields, with cutting-edge advancements attracting international attention and capital.

Despite the inherent risks that accompany such rapid change, the long-term prospects for these economies remain compelling.

Debt dynamics and fiscal resilience

The conditions and expectations for emerging market bonds mirror those in the US and Europe: low spreads coupled with the idiosyncratic risks related to issuers mean that quality should be the priority for sovereign and corporate debt investments. A mix of Asian corporate bonds and government securities could provide an interesting addition to a well-diversified portfolio – though, as with USD-denominated bonds, currency risks must always be considered.

However, it is worth noting that many emerging economies face high debt levels and limited fiscal flexibility. Elevated government spending and rigid budgets restrict the ability to respond to shocks, making these markets more vulnerable to external pressures and refinancing risks.

Emerging markets - a crossroads of global competition

Emerging markets stand at the intersection of global competition and rapid transformation. As the battle for critical resources accelerates and policy landscapes evolve, these regions offer investors both challenges and opportunities.

For those prepared to navigate volatility and embrace innovation, emerging markets remain a vital engine for growth and diversification. The contest for control – especially regarding resources – will continue to shape global supply chains and investment strategies, while the ability to identify resilient sectors and respond to geopolitical developments will be key to unlocking long-term value across these diverse economies.

Learn more about Deutsche Bank’s ten key investment themes for the year ahead in our PERSPECTIVES Annual Outlook 2026: Investing for tomorrow.