Investing insights

Our global Chief Investment Office (CIO) publishes our economic outlook and investing themes. From thought-leadership on ESG and long-term trends to timely commentary on market developments, our investing insights are designed to help each client shape their financial tomorrow.

Economic and market outlook

CIO Video Update

Annual outlook 2026 – Investing in tomorrow: opportunities and risks

Global Chief Investment Officer, Christian Nolting and the CIO team discuss where the global economy and markets may be headed – and what this could mean for investors in the year ahead.

Jan 13, 2026

PERSPECTIVES Annual Outlook

Cyclical impulses: key investment themes for Europe in 2026

Europe's story is one of cautious optimism, strategic intervention, and the search for sustainable growth. Deutsche Bank Private Bank’s CIO for Germany, Ulrich Stephan, outlines what investors should watch out for in the year ahead.

Jan 09, 2026

PERSPECTIVES Annual Outlook

Fierce competition: key investment themes for emerging markets in 2026

Deutsche Bank’s CIO for Emerging Markets, Professor Dr Jacky Tang, explores how fierce competition for critical commodities, shifting supply chains and evolving policy landscapes are shaping risks and opportunities for investors in 2026.

Jan 07, 2026

PERSPECTIVES Annual Outlook

Transformative forces: key investment themes for the US in 2026

Deepak Puri, Deutsche Bank Private Bank’s CIO for the Americas, outlines how AI-driven innovation, economic resilience, and shifting market dynamics in the US are setting the scene for recovery and opportunity in 2026 and beyond.

Jan 07, 2026

PERSPECTIVES Annual Outlook

Annual outlook 2026: Investing in tomorrow

The global economy is in flux, trade flows are shifting and new technologies are redrawing the economic map. In PERSPECTIVES 2026, we look to the year ahead across our ten key investment themes, identifying opportunities and risks for investors.

Dec 05, 2025

PERSPECTIVES Special

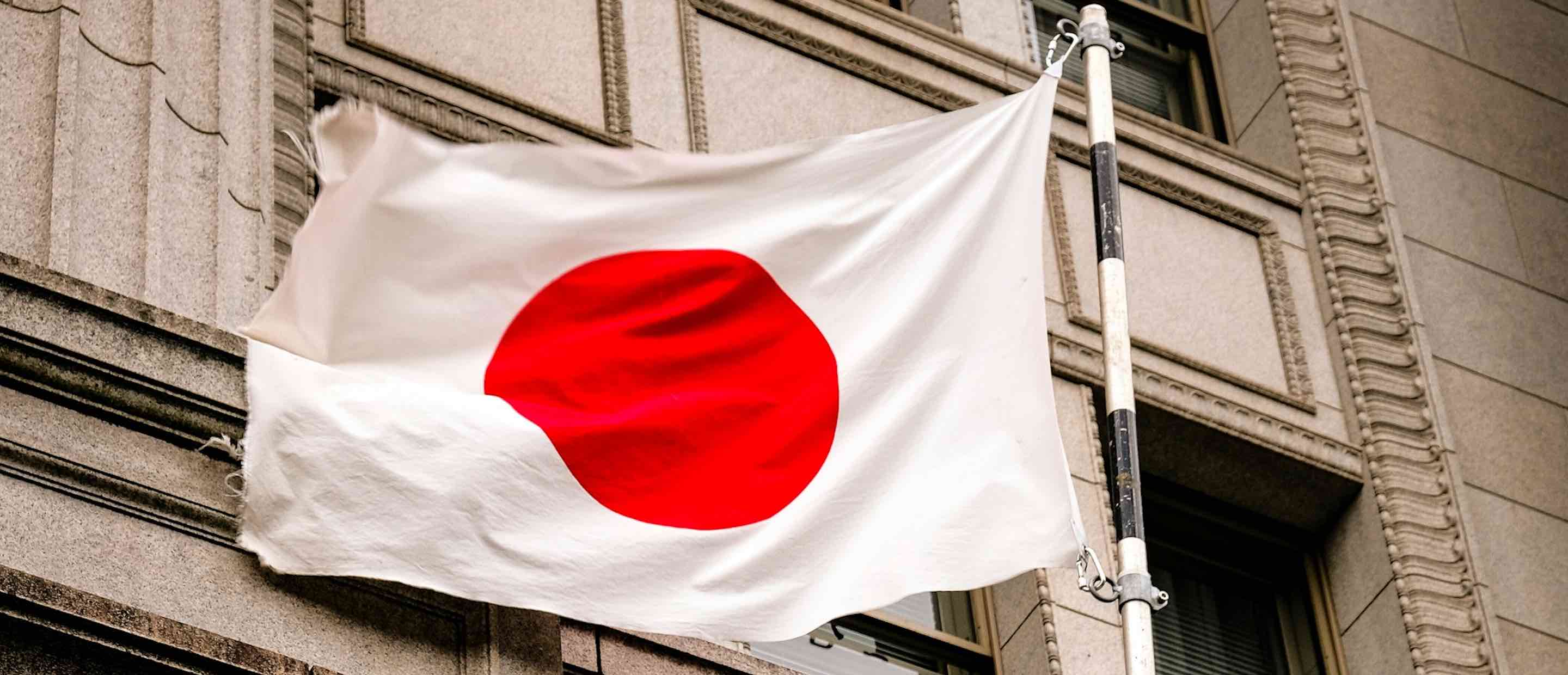

Japan 2026 Outlook: Strategic reorientation amid policy normalisation and structural reforms

In this PERSPECTIVES Special we explore how Japan’s evolving geoeconomic strategy, innovation push, and corporate transformation are set to reshape the investment landscape in the years ahead.

Jan 22, 2026

PERSPECTIVES Memo

Greenland tensions: US announces new tariffs on European countries

US President Donald Trump announced on social media that the United States would implement a 10% tariff on eight European nations (Germany, France, the United Kingdom, the Netherlands, Norway, Sweden, Finland and Denmark) with effect from February 1, amid opposition to US intentions for Greenland. Read more.

Jan 19, 2026

PERSPECTIVES Memo

Venezuela tricolor flag with stars on a pole

Financial markets remain largely unaffected by the removal of Venezuela‘s President Maduro. Our positive market and economy outlook for 2026 also remains unchanged.

Jan 06, 2026

PERSPECTIVES Special

Spain: Impressive economic growth, once again

In this PERSPECTIVES Special – Spain: Impressive economic growth, once again, we explore the reasons for this success, while also addressing the structural challenges that Spain faces, which include productivity gaps, housing shortages, and political uncertainty. Read for more information.

Nov 28, 2025

PERSPECTIVES Memo

UK budget: navigating difficult waters

On Wednesday, the Chancellor of the Exchequer, Rachel Reeves, delivered her second Autumn Budget against a backdrop of slowing growth, elevated borrowing costs, and persistent domestic political uncertainty.

Nov 27, 2025

PERSPECTIVES Viewpoint Fixed Income

Credit – Income over compression

Carry is taking centre stage again in 2026 as credit markets navigate elevated supply, tight valuations, and the accelerating AI financing cycle.

Jan 22, 2026

PERSPECTIVES Viewpoint FX

Politics, monetary policy, fiscal stimuli

In this publication we explore how politics, monetary policy and fiscal stimuli are set to reshape major currency paths in 2026 and present our corresponding exchange rate forecasts.

Jan 16, 2026

PERSPECTIVES Viewpoint Fixed Income

Steep curves and fiscal crossroads

Global bond markets are entering a new era of steeper curves and persistently higher yields. We explore what this landscape could mean for investors.

Dec 16, 2025

Navigating metals, energy & strategic materials

Ranging from gold to rare earths, this PERSPECTIVES Viewpoint dives into the forces driving volatility, opportunity, and risk across the commodity spectrum.

Dec 15, 2025

PERSPECTIVES Viewpoint Equity

Japan – Takaichi and corporate reforms

This report examines the key drivers behind the momentum in Japan’s stock market and outlines the factors drawing increased investor interest. Read for more information.

Dec 10, 2025

PERSPECTIVES Viewpoint Equity

China’s Q3 earnings: sectoral divergence

PERSPECTIVES Viewpoint Equity: China’s Q3 earnings: sectoral divergence, spotlights how policy support, AI infrastructure, and green energy are helping to drive selective investment opportunities. Read for more information.

Nov 28, 2025