As artificial intelligence reshapes the global economy, the US stands at the forefront of a new era. Deepak Puri, Deutsche Bank Private Bank’s CIO for the Americas, outlines how AI-driven innovation, economic resilience, and shifting market dynamics in the country are setting the scene for recovery and opportunity in 2026 and beyond.

The world is undergoing a period of profound transformation. A driving force of this change is artificial intelligence (AI), a technology that has rapidly evolved from futuristic concept to foundational driver of potential economic and social progress.

AI’s impact has been likened to that of electricity by Jeff Bezos, while fellow industry leader Bill Gates predicts it will revolutionise daily life, from healthcare access to work and travel. This optimism is not limited to entrepreneurs in the space; market participants worldwide now agree that AI will remain a structural growth engine well beyond 2026.

But what does this mean for the US? As the nation navigates the aftermath of recent political and economic shocks, AI is emerging as both a catalyst for recovery and a source of new challenges.

As we look to the year ahead, key forces shaping the US outlook include the complex interplay between AI investment and development, economic policy, and the evolving geopolitical landscape.

Geopolitics and the US-China rivalry

Political instability has become a defining feature of the current environment leading to ongoing shifts in the global economy and changing patterns in international trade.

A plethora of ongoing and emerging crises continues to test investors’ resilience. Many of the risk factors for 2026 are already familiar. At a geopolitical level, these include the ongoing situation in the Middle East, the fallout from Russia’s war on Ukraine, and tensions between China and Taiwan. The latter carries far-reaching economic implications due to Taiwan’s pivotal role in the production of semiconductors – a fundamental component of AI technology.

“These geopolitical hotspots can always flare up with major financial market implications,” notes Deepak Puri, Deutsche Bank Private Bank’s CIO for the Americas.

At an international level, the most significant political issue is the dispute between the US and China – a years-long battle between the world’s two largest economies as they compete for technological and global hegemony. This rivalry reached a new level in early April 2025 when President Donald Trump announced “reciprocal punitive tariffs”, and China responded in kind by threatening retaliatory tariffs and expanded trade restrictions. No clear winner emerged from this sabre-rattling: both sides hold strong cards.

Nevertheless, the tide shifted towards the end of the year. “A degree of pragmatism is back,” says Puri. “There was a tariff truce at the start of November 2025 which has helped ease some of the immediate concerns between the two nations,” he adds. “But this is not fundamentally a stable situation, and there has not been a strategic pivot from either side.”

“Geopolitical rivalries have multiple dimensions. In this instance, technology and geopolitics are too closely intertwined,” Puri remarks. In a move that could reshape trade dynamics, Beijing agreed to relax its export controls on rare earths, while both parties committed to a one-year suspension of the punitive tariffs that have strained relations. Yet, the durability of this accord remains in question, given the unpredictable nature of recent political manoeuvres.

“For China, access to high-end semiconductors as well as cheap and reliable energy remains at the centre of their decision-making,” Puri highlights. “For the US, reducing dependency on China is now a national security priority, and tariffs are a central tool to secure technological leadership and supply-chain resilience. Both countries have powerful trade levers to support these objectives.”

Targeted tariffs may make sense for the US in the short term – these protectionist measures are designed to attract investment, create jobs, and weaken economic “rivals” – but such actions constitute massive interventions in economic activity, in our view.

Still, tariffs remain Washington’s strongest lever. Despite a sharp drop in Chinese exports, the US is still a critical market, with roughly 10% of all Chinese goods and services crossing the Pacific, according to estimates, making further hikes costly. The US also wields export curbs on high-tech sectors like semiconductors and aircraft.

Beijing, however, has a formidable advantage: rare earths. These metals are essential for everything from smartphones to industrial robots and fighter jets, and China dominates both production and processing, meaning major US companies rely heavily on Chinese minerals to manufacture their products. Between 2020 and 2023, an estimated 70% of US rare earth compound and metal imports came from China[1]– a dependency Washington has struggled to break.

“The US can limit exports where it is a market leader, such as in advanced semiconductors, while China can restrict exports of rare earth metals where it has a dominant position. These are real strategic commodities with few other geographic sources or substitutes,” Puri explains.

“But both countries are acutely aware that tariffs and other restrictions have costs, both for their corporations and consumers. That should discourage further tariff action, at least for now.”

The race for AI supremacy

Meanwhile, the race for AI supremacy shows no signs of slowing. The technology is set to transform the way people live, work, and play – and the US continues to lead the way by a wide margin.

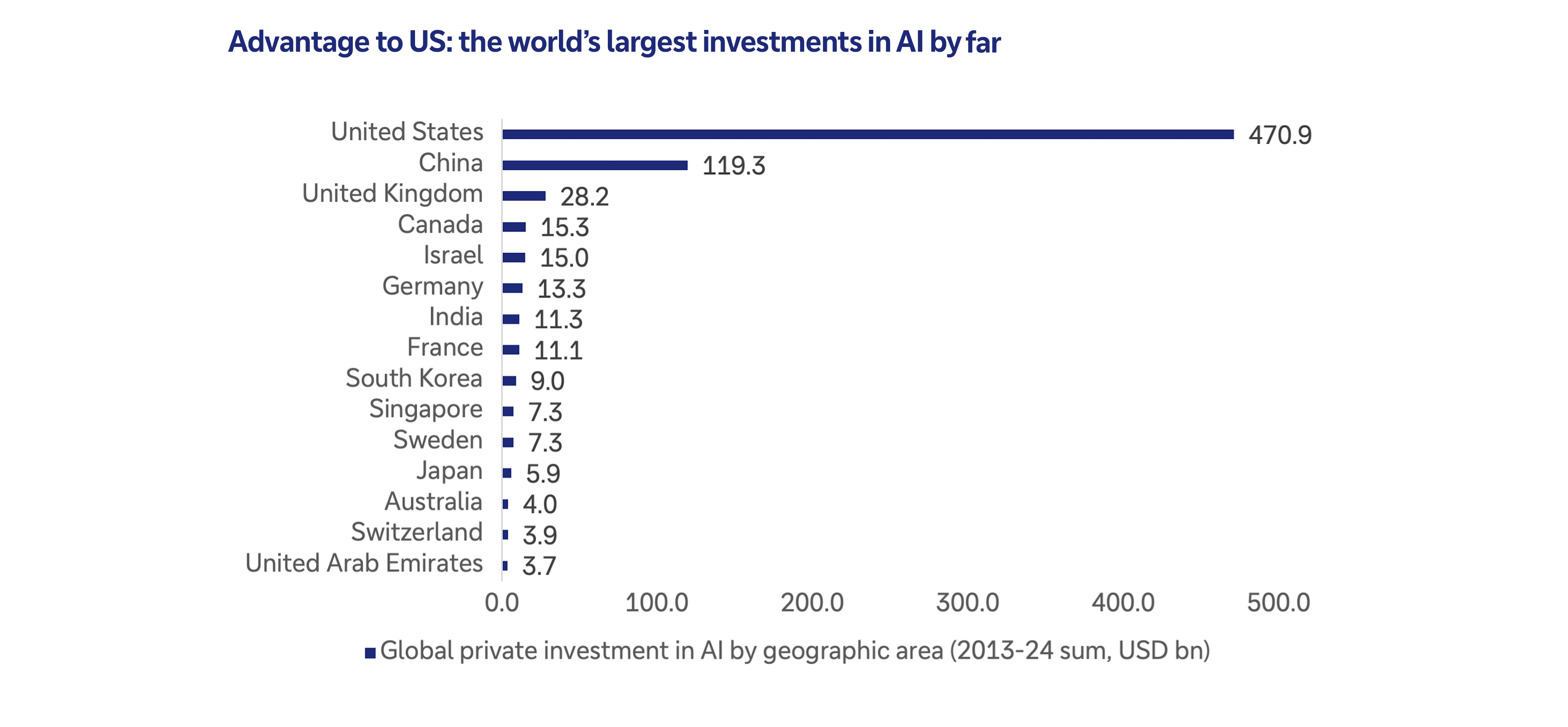

Between 2013 to 2024, US private investment in AI surpassed 470 billion US dollars, according to Stanford University’s Artificial Intelligence Index Report 2025. China trailed in second with nearly 120 billion US dollars of investment[2]. For the time being, the US’s strategic edge in the sector remains clear. These massive inflows, which span far beyond the two superpowers, cover areas across the AI ecosystem such as research and development, data centres, energy and utility infrastructure, hardware, and software. Ongoing investment in AI is contributing to economic momentum.