Japanese equities have experienced significant growth, underpinned by wide-ranging government reforms, targeted investment in advanced sectors such as artificial intelligence and semiconductors, and a renewed emphasis on capital efficiency and shareholder returns. Supported by record profits and resilient domestic consumption, the upward trajectory in company earnings is likely to persist through 2026. This report examines the key drivers behind the momentum in Japan’s stock market and outlines the factors drawing increased investor interest.

Key takeaways

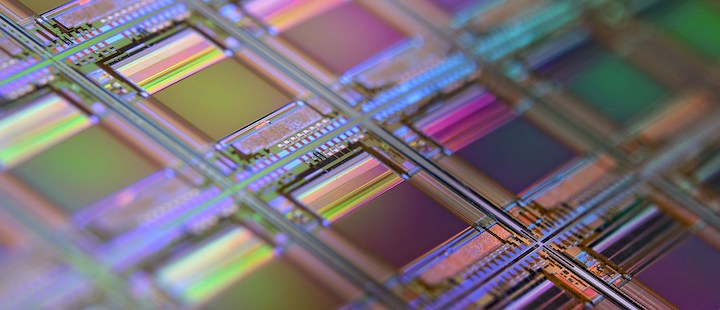

- Japanese equities are surging, driven by Prime Minister Sanae Takaichi’s pro-growth policies, aggressive fiscal spending, and reforms targeting strategic sectors like AI, semiconductors, and defence.

- Corporate governance reforms are shifting companies from cash hoarding to capital efficiency, with increased focus on shareholder returns, transparency, and operational restructuring.

- Record profits, robust AI demand, and resilient domestic consumption are fuelling strong earnings momentum, positioning Japanese equities for continued growth into 2026.